Potential Shift in Taxation and Its Impact on the Stock Market

The government and the ruling party have initiated serious discussions regarding the introduction of a separate taxation system for dividend income, which has drawn significant attention from investors. This potential change could reshape the stock market landscape next year. Specifically, as the possibility of reducing the maximum tax rate for separate taxation from the initial 35% to 25% increases, there is growing interest in whether this tax reform could serve as a new upward driver for the domestic stock market.

Park Seung-young, a researcher at Hanwha Investment & Securities, stated, “If separate taxation on dividend income is implemented, dividends will shift in status from ‘unearned income’ subject to punitive high taxes to a ‘wealth-building tool’ for stable returns. In the medium to long term, this could become a catalyst for shaking up the structure of Korea’s asset market.”

Individual investors, facing reduced tax burdens, are expected to show ‘accumulation demand,’ holding stocks longer and in greater quantities. Analysts also suggest that major shareholders may have stronger incentives to consider expanding dividends due to the tax rate cut.

The End of Real Estate Dominance? Changes Brought by Tax Reform

Real estate has long been Korea’s representative investment method, backed by tax benefits and asset stability, making it a rational choice. In particular, single-homeowners are exempt from taxes on capital gains up to 1.2 billion won upon sale, and rental income up to 20 million won annually is tax-free, offering several advantages over stocks.

However, if dividend income is taxed separately without being added to comprehensive income, the real estate-dominated investment structure could crack. As tax savings and stable cash flow gain prominence, the appeal of dividend investing may grow, potentially shifting idle funds from real estate to stocks.

Of course, even if the government accelerates tax reforms like separate taxation on dividends, their effectiveness will be limited unless major shareholders support the changes.

Park Seung-young points out, “No matter how much the government changes the system, major shareholders will only increase dividends if they deem it beneficial. It is unrealistic to expect or demand that they expand dividends for the benefit of minority shareholders or the public.”

The Effect of Dividend Expansion Depends on Major Shareholders’ Choices

Ultimately, changes in the stock market landscape depend on the choices and judgments of major shareholders. So, what is the current dividend status of Kospi-listed companies?

According to Hanwha Investment & Securities on the 10th, the total dividends of Kospi-listed companies last year amounted to 50 trillion Korean won. Among them, the six conglomerates—Samsung, SK, Hyundai Motor, LG, Lotte, and HD Hyundai—where major shareholders exert influence, accounted for 28 trillion won, or 56% of the total. Samsung Group alone contributed 13.7 trillion won, half of the total.

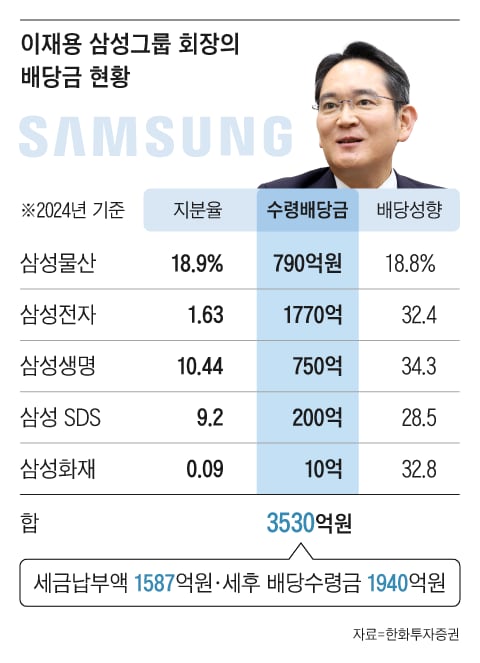

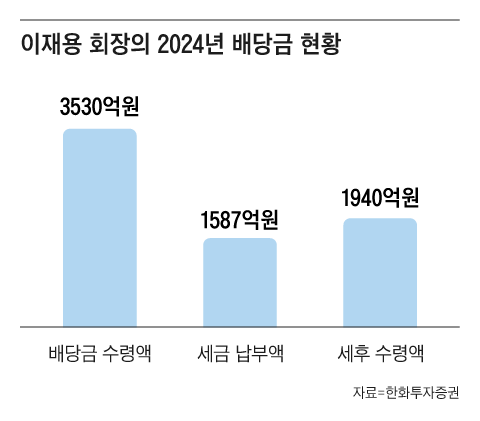

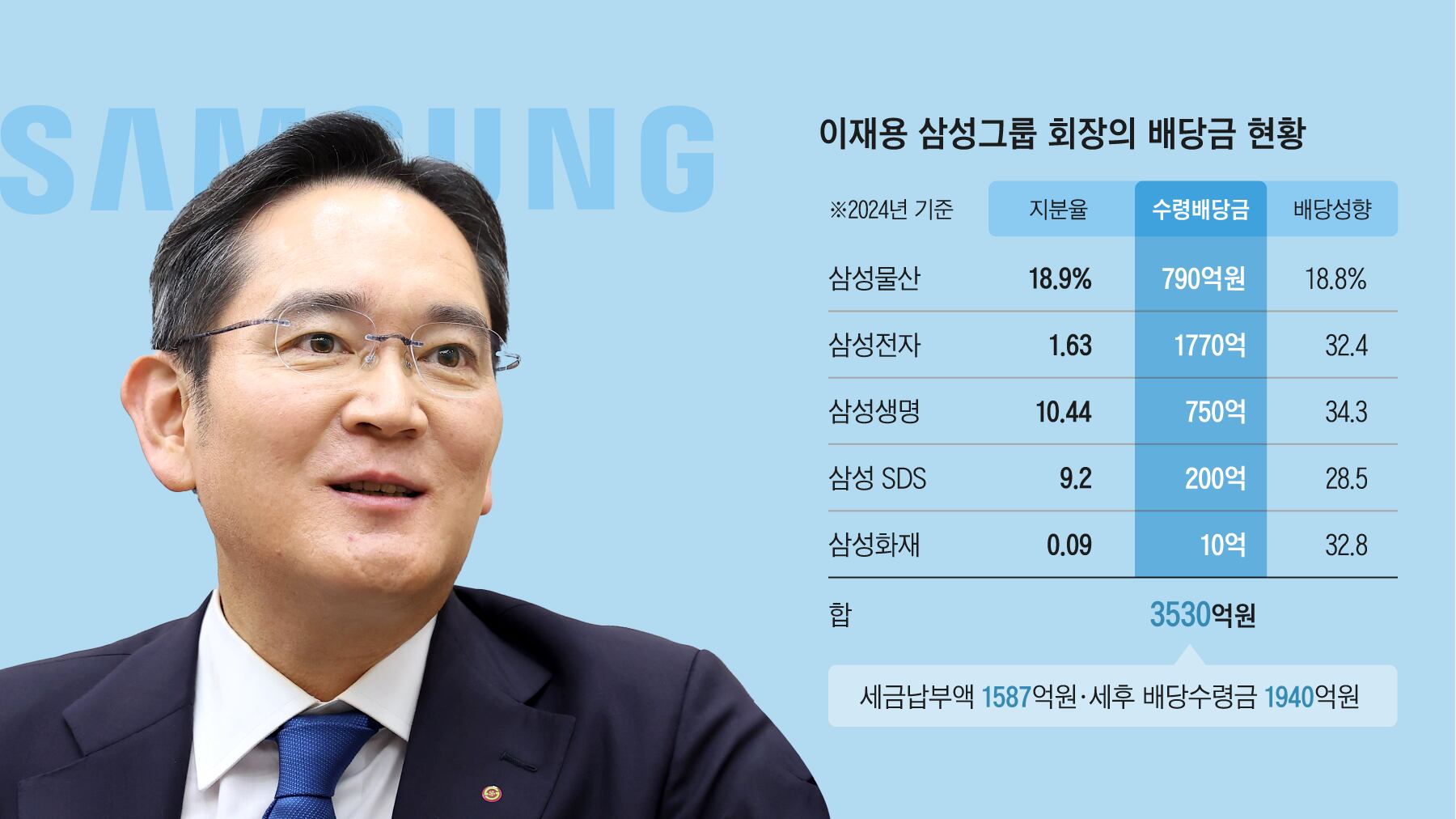

Samsung Electronics Chairman Lee Jae-yong received a total of 353 billion won in dividends in 2024. After paying 158.7 billion won in comprehensive income tax (49.5%), his estimated net receipt was approximately 194 billion won.

Trickle-Down Effect Possible…Can Minority Shareholders Smile Too?

Will the government’s tax reform provide sufficient incentives for Chairman Lee to reduce his tax burden?

Currently, the listed companies in which Chairman Lee holds shares are Samsung C&T, Samsung Electronics, Samsung Life Insurance, Samsung SDS, and Samsung Fire & Marine Insurance.

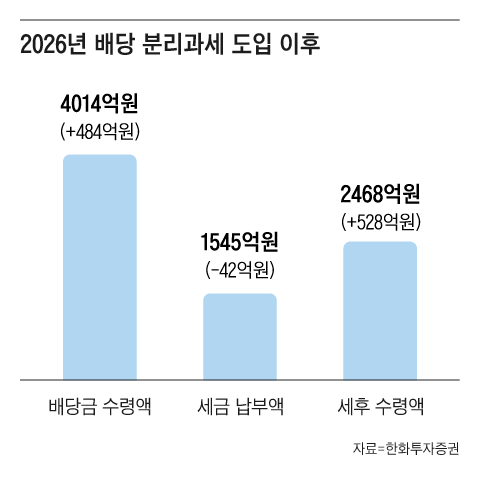

Assuming these five companies meet the conditions for separate taxation (dividend payout ratio of 25%, average annual dividend growth rate of over 5% for three years) and Chairman Lee’s stake remains the same as in 2024, Hanwha Investment & Securities calculated that his estimated total dividends in 2027 would be 401.4 billion won.

If the government applies the initially proposed maximum separate tax rate of 38.5%, the tax payable would be 154.5 billion won, and the net dividend receipt would be 246.8 billion won. Compared to 2024, this would reduce taxes by 4.2 billion won and increase net dividends by 52.8 billion won.

If the maximum separate tax rate is finalized at 27.5%, lower than 38.5%, Chairman Lee’s net receipt would rise to 291 billion won, an increase of about 100 billion won from now. What decision will he make after the government’s tax reform?

Only if major shareholders have sufficient incentives to expand dividends can the ‘trickle-down effect,’ where benefits naturally extend to minority shareholders, become a reality. The separate taxation of dividend income is expected to be a litmus test for long-term changes in Korea’s asset market structure, beyond a simple tax reform.

Leave a Reply

You must be logged in to post a comment.